What is a Payment Aggregator?

The rise of digital payments and the changing consumer trends with the pandemic have meant that businesses/merchants have been forced to switch quickly from a single channel (in-store) to an omnichannel (in-store, online, and doorstep) presence. As more and more consumers are shopping online and opting for contactless (digital) payment modes across offline & doorsteps channel as well, embedding the payments experience in consumer journeys and managing payments infrastructure have become extremely important to businesses in virtually every industry.

It has now become quintessential for a business to partner with a Payment Aggregator or a Payment Gateway (PA/PG) to not only fulfill the payment requirements of its end consumers but be able to offer them the best-in-class payments experience across any channel (in-store, online, and doorstep) So, today, we will deep dive into –

- What is a Payment Gateway & Who is a Payment Aggregator?

- Who are the players involved in the Payment Process Flow?

- How does Payment Processing work? (Example of a card transaction)

- Factors to consider for businesses/merchants while choosing the right Payment Aggregator

What is a Payment Gateway & Who is a Payment Aggregator?

A Payment Gateway is a technology platform that allows any business/merchant to accept digital payments and enables the businesses/merchants to offer a multitude of digital payment options to their consumers including cards (debit, credit, corporate), UPI, Aadhar Pay, Net Banking, Wallets and more.

The key difference between a Payment Gateway & Aggregator is that while a Payment Gateway only provides the technology, a Payment Aggregator would also receive payments from consumers on the business/merchant’s behalf and then settle the same in their account.

Let’s look at the below example to explain –

Suppose a business wants to provide Net Banking payment options to its consumers, then one way to go about it is that the business ties up with different banks; however, this approach would entail a lot of resources, time & capital. Another way to go about this for a business is to tie up with a Payment Aggregator, which would enable the business to offer various payment options including Net Banking, while eliminating the need to go and tie up with each bank. The technology that the Payment Aggregator leverages/uses to securely transfer consumer payment information for processing here is known as Payment Gateway. Most of the Payment Aggregators have an in-house technology stack i.e., a Payment Gateway, or will tie-up with third parties for the solution.

Who are the players involved in the Payment Process Flow?

There are majorly five players involved in traditional Payment Processing as mentioned below –

- Consumer – Individual, who has initiated the transaction on a business/merchant’s site/store to avail goods/services.

- Merchant/Business – enterprise offering the goods/services to the consumer and receiving payment from the consumer for the same.

- Issuer or Issuing Bank – The financial institution/Bank with which the consumer has the account with the required funds for the transaction.

- Acquirer – financial institution with whom Payment Aggregator has a bank account for accepting payments from consumers of business and then settling it into the business/merchant’s account

- Card Networks (in case of card transactions) – These are card infrastructure providers like that of VISA, Mastercard, and RuPay. In the case of card transactions, they identify the Issuer based on the consumer payment details and route authorization requests & responses between Issuer and Acquirer.

How does Payment Processing work?

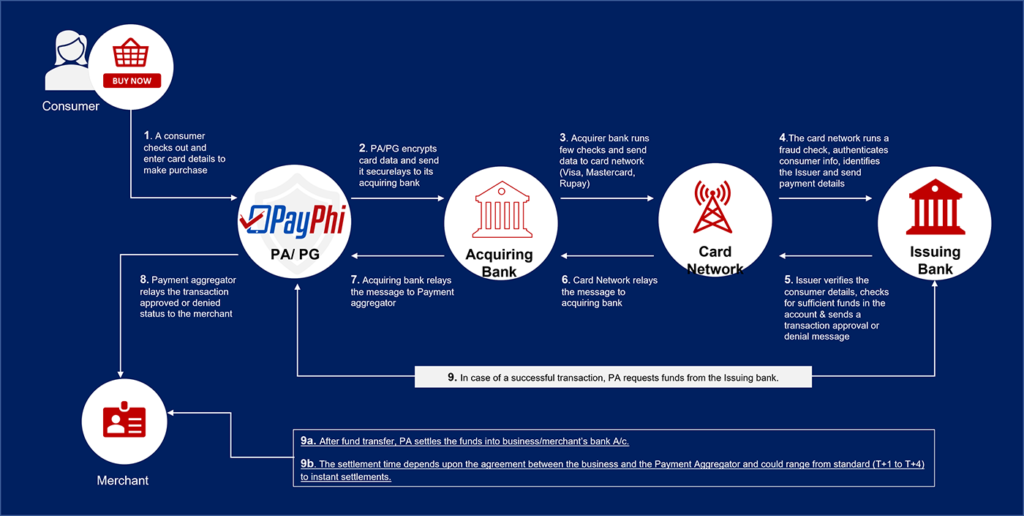

We will take an example of a card transaction to understand the flow of payment processing and

the work of Payment Aggregator –

- A consumer checks out on a business’s online marketplace and chooses a card as a payment option. He / She then enters his or her card details for payment processing.

- Payment Gateway of the aggregator tokenizes or encrypts these payment details and performs a fraud check before sending the information to its acquiring bank.

- After performing a few checks, the acquirer sends the consumer information to the respective card network such as VISA, Mastercard, and RuPay among others.

- The card network runs a fraud check, authenticates the consumer information, identifies the Issuer, and passes on the consumer’s payment information to the Issuer

- The Issuer verifies the consumer details, checks for sufficient balance in the account, and then send a transaction success or failure message to the card network

- The card network then relays the message to -> Acquiring Bank -> Payment Aggregator -> Merchant/Business. In turn, the merchant/business informs the consumer of the status of the transaction.

- In case of a successful transaction, the acquiring bank connected to the Payment Aggregator requests funds from the Issuer.

- Issuer provides the funds to the acquirer’s bank account and in turn, a Payment Aggregator settles the funds into the business/merchant’s bank account. The settlement time depends upon the agreement between the business and the Payment Aggregator and can be instantaneous also.

Types of Payment Aggregators/Gateways & their Integrations?

PA/PG can be of two types i.e., either a PA/PG provided by Banks or a private third-party platform like PayPhi. Traditionally, only banks used to provide PA/PG services but over the last two decades, third-party PA/PGs have redefined the contours of digital payments with innovative technology solutions.

The types of integration of PA/PG with business/merchant depends upon the requirement of the business/merchant and the kind of payment experience it wishes to provide to its consumers. There are broadly 3 types of integrations –

- Hosted – The consumer of the business/merchant is redirected to the PA/PG’s page for entering payment details. This allows easy integration for merchants/businesses, where PCI DSS compliance is handled by the PA/PG.

- Self-Hosted – The consumer remains on the business/merchant’s website page or application for processing payments and PA/PG is integrated within the business/merchant’s application

- Offline – Payment instruments like QR codes, and payment links among others.

How to choose the right PA/PG?

Now, that we have covered the different aspects of payment processing and have understood what exactly the role of a Payment Aggregator is, let’s look at the key factors that a business/merchant should consider while choosing the best-fit Payment Aggregator –

- Omnichannel Capability of the PA/PG – In today’s world, businesses need to have an omnichannel presence i.e., online, in-store, and doorstep to compete at the highest levels in respective industries and ensure that they can offer best in class payment experience to their consumers across all the channels so as not to lose to the competition. To achieve this, a business/merchant needs to partner with a PA/PG, which enables the business/merchant to accept payments across all consumer touchpoints through a single unified platform, thereby providing a seamless and uniform payment experience to the consumers of the businesses across all the channels. This approach also eliminates the need for a business to have multiple payment aggregators/platforms for different channels to support diverse payment instruments while addressing the issues of separate integration with multiple payment platforms (multiplied tech efforts & manual interventions), and disparate experiences for consumers, reconciliation among others.

- Catering to all available Payment Methods & Capability to easily incorporate new-age payment methods – the landscape of digital payments is very much dynamic and is constantly evolving along with the consumer needs, trends & behaviour. Therefore, a business needs to be able to provide all the payment methods as preferred by its consumer base and its payment aggregator should have the capability to easily introduce additional new-age payment methods as desired by businesses & consumers.

- Security Infrastructure – The security of consumer data & transactions is of utmost importance for a business while processing digital payments to ensure the continuing trust of the consumer in the business. Therefore, a business should ensure that its partner Payment Aggregator has industry certification like PCI/PA DSS among others and can ensure the prevention and detection of fraud through adequate data security infrastructures.

- Scalability – As the businesses grow, the number of transactions per second its payment aggregator needs to process also scales up accordingly. Therefore, it is important for a business to ensure that the Payment Aggregator’s architecture is such that it can manage large volumes of transactions and users concurrently within a complex business environment.

- Payments Partner & not a vendor – Businesses/Merchants should not look at Payment Aggregator as any other vendor but should choose a PA/PG, which becomes a Payments Partner and manages all the aspects of the payments from end to end for the business. An important feature of a good payment aggregator is to be able to offer excellent support to the businesses for any issues related to payments and offer Payments ++ services as well such as API-based reconciliation, transaction reports, dynamic dashboards, and analytics among others. In nutshell, a business while deciding on a Payment Aggregator should be careful in terms of whether it is choosing a Partner or a vendor.

If your business is looking at a one-stop PA/PG solution that scores highly in all of the above-mentioned metrics, then you need to look no further than – PayPhi (a multiple award-winning digital payment platform of Phi Commerce). PayPhi powers frictionless payments for businesses/enterprises backed by an omnichannel digital platform, deep payments tech expertise & vertical-specific insights. Using its omnichannel payment enablement strategy – PayPhi helps businesses digitize payments/collections, enabling them to accept any mode of payment (270+ payment modes supported) across all the channels – online, doorstep, and in-store (offline), thereby enabling an inclusive approach to payments.